change in working capital formula cash flow

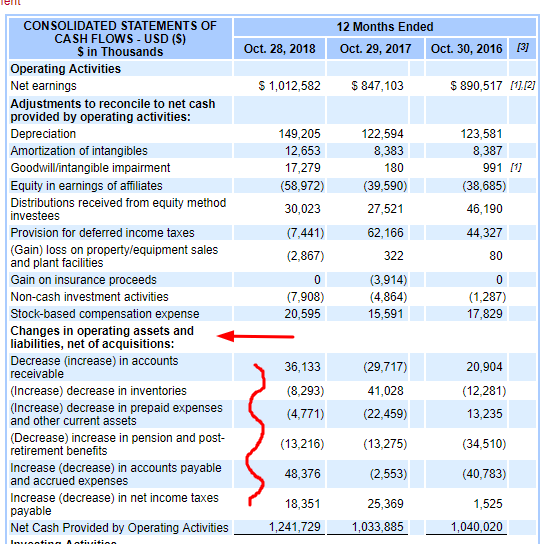

Same as step 3 above. Operating Activities includes cash received from Sales cash expenses paid for direct costs as well as payment is done for funding working capital.

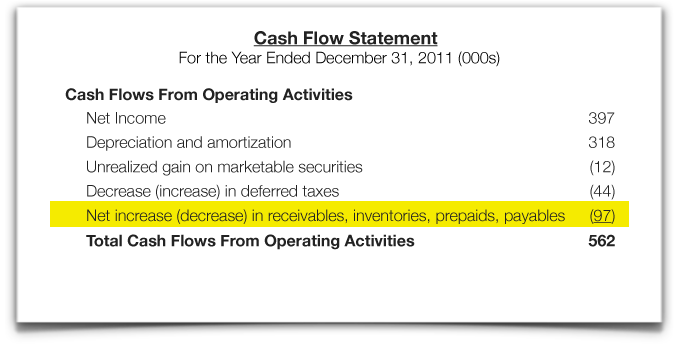

Cash Flow Statement How A Statement Of Cash Flows Works

This is the money used for day-to-day business operations including cash payments.

. Unlevered free cash flow ie cash flows before interest payments is defined as EBITDA - CAPEX - changes in net working capital - taxes. This is the generally accepted definition. If there are mandatory repayments of debt then some analysts utilize levered free cash flow which is the same formula above but less interest and mandatory principal repayments.

The formula for free cash flow can be derived by using the following steps. Cash Flow Statement Formula. To learn more check out CFIs Business Valuation Modeling Course.

85000 0 9000 -10000 66000. Capital refers to debt and equity financing which are the two common sources of funds for companies that are used to invest in cash flow generative assets and derive economic benefits. Looking for more details on the operating cash flow formula.

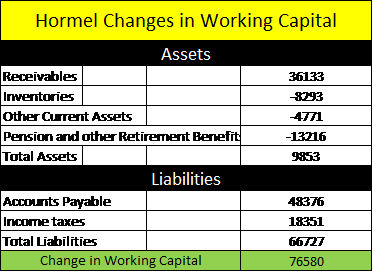

Free Cash Flow to firm formula can be represented in the following Three way. The working capital changes that affect FCFF are items such as Inventories Accounts Receivables and Accounts Payable Accounts Receivables And Accounts Payable While. A cash flow statement is a record of financial transactions over time.

So if the change in net working capital is positive it means that the company has purchased more current assets in the current period and that purchase is basically outflow of the cash. Operating Cash Flow Operating Income Non-Cash Charges Change in Working Capital Taxes. However if the change in NWC is negative the business model of the company might require.

Current liabilities are best paid with current assets like cash cash equivalents and. A decrease in inventory would be added to net sales. Change in Working Capital 10000.

The current liabilities section typically includes accounts payable accrued. In a cash flow statement you will find information like. The Discounted Cash Flow method is all about future cash flows.

That means in a typical year Randi generates 66000 in positive cash flow from her typical operating activities. Change in Working Capital. Future cash flows are.

The free cash flow can be calculated starting from the operating profit EBIT MINUS the fictional income tax on this EBIT PLUS the depreciation on fixed assets MINUS the change in provisions MINUS the investment in net induced working capital MINUS the investments in fixed assets. LFCF EBITDA - change in net working capital - CAPEX - mandatory debt payments. Firstly determine the net income of the company from the income statement.

So a positive change in net working capital is cash outflow. The LFCF formula is as follows. It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling What is Financial Modeling Financial modeling is performed in Excel to forecast a companys financial performance.

Read more in the past but may affect the forecast of future Free Cash Flow to Firm. Abbreviated it looks like this. Levered free cash flow earned income before interest taxes depreciation and amortization - change in net working capital - capital expenditures - mandatory debt payments.

Same as step 2 above. How to calculate levered free cash flow. A cash flow statement is one of the most important accounting documents for small businesses.

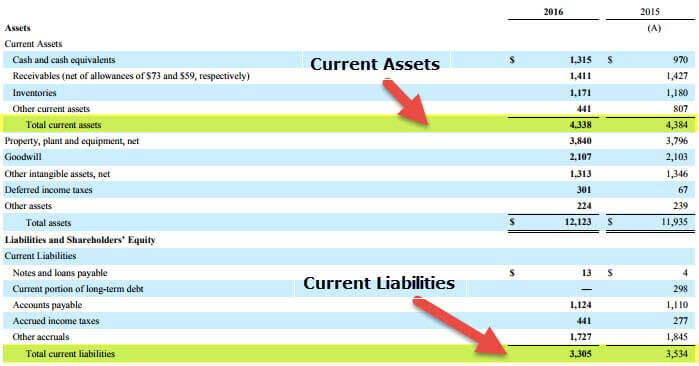

The working capital ratio also called the current ratio is a liquidity ratio that measures a firms ability to pay off its current liabilities with current assets. Inventory Value and Cash Flow If the inventory was paid with cash the increase in the value of inventory is deducted from net sales. Randis operating cash flow formula is represented by.

If the change in NWC is positive the company collects and holds onto cash earlier. If something has been paid off then the difference in the value owed from one year to the next has to be subtracted from net income. Typical current assets that are included in the net working capital calculation are cash accounts receivable inventory and short-term investments.

The short definition of FCFF is the cash flow available to all capital contributors after the firm pays all operating expenses taxes and other costs of. The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. The net working capital formula is calculated by subtracting the current liabilities from the current assets.

Free cash flow FCF is the money a company has left over after paying its operating expenses and capital expenditures. What is Working Capital. Invested Capital Fixed Assets Net Working Capital NWC.

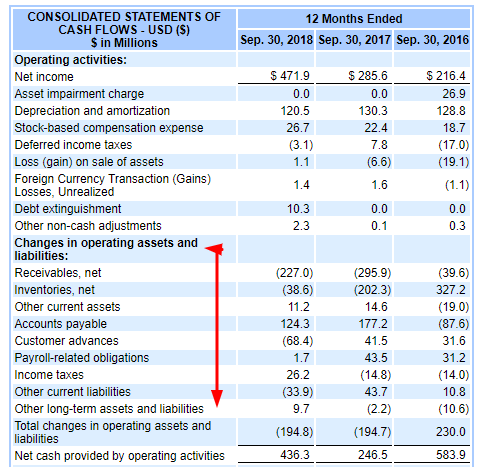

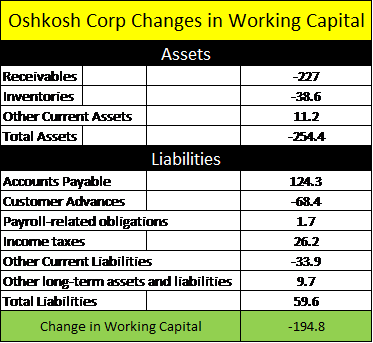

173 million reduction of cash due to a change in working capital 18343 million of net cash from operating activities. Read more and it is recorded on the statement of cash flows Statement Of Cash Flows A Statement of Cash Flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business. Similarly change in net working capital helps us to understand the cash flow position of the company.

Here is what the basic equation looks like. Operating Cash Flow Formula vs Free Cash Flow Formula. The more free cash flow a company has the more it can allocate to dividends.

Similarly negative change in. The working capital ratio is important to creditors because it shows the liquidity of the company. The Change in Net Working Capital NWC section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period.

While the operating cash flow formula is great for assessing how much a company generated from operations there is one major.

Change In Net Working Capital Nwc Formula And Calculator

Change In Net Working Capital Nwc Formula And Calculator

Introduction To Financial Statements Cash Flow Statement The Kaplan Group

What Is A Cash Flow Statement What Are The Three Sections Wikiaccounting

Net Working Capital Definition Formula How To Calculate

Change In Working Capital Video Tutorial W Excel Download

Cash Flow Formula How To Calculate Cash Flow With Examples

Change In Working Capital Video Tutorial W Excel Download

Cash Flow Formula How To Calculate Cash Flow With Examples

Changes In Net Working Capital All You Need To Know

Working Capital Example Formula

How To Find And Calculate Changes In Working Capital For Owner S Earnings

How To Find And Calculate Changes In Working Capital For Owner S Earnings

How To Find And Calculate Changes In Working Capital For Owner S Earnings

Cash Flow From Operations Plan Projections

Change In Working Capital Video Tutorial W Excel Download

How To Find And Calculate Changes In Working Capital For Owner S Earnings

/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)