does texas have inheritance tax 2021

Each are due by the tax day of the year following the individuals death. Estate tax applies at the federal level but very few people actually have to pay it.

How Do State And Local Individual Income Taxes Work Tax Policy Center

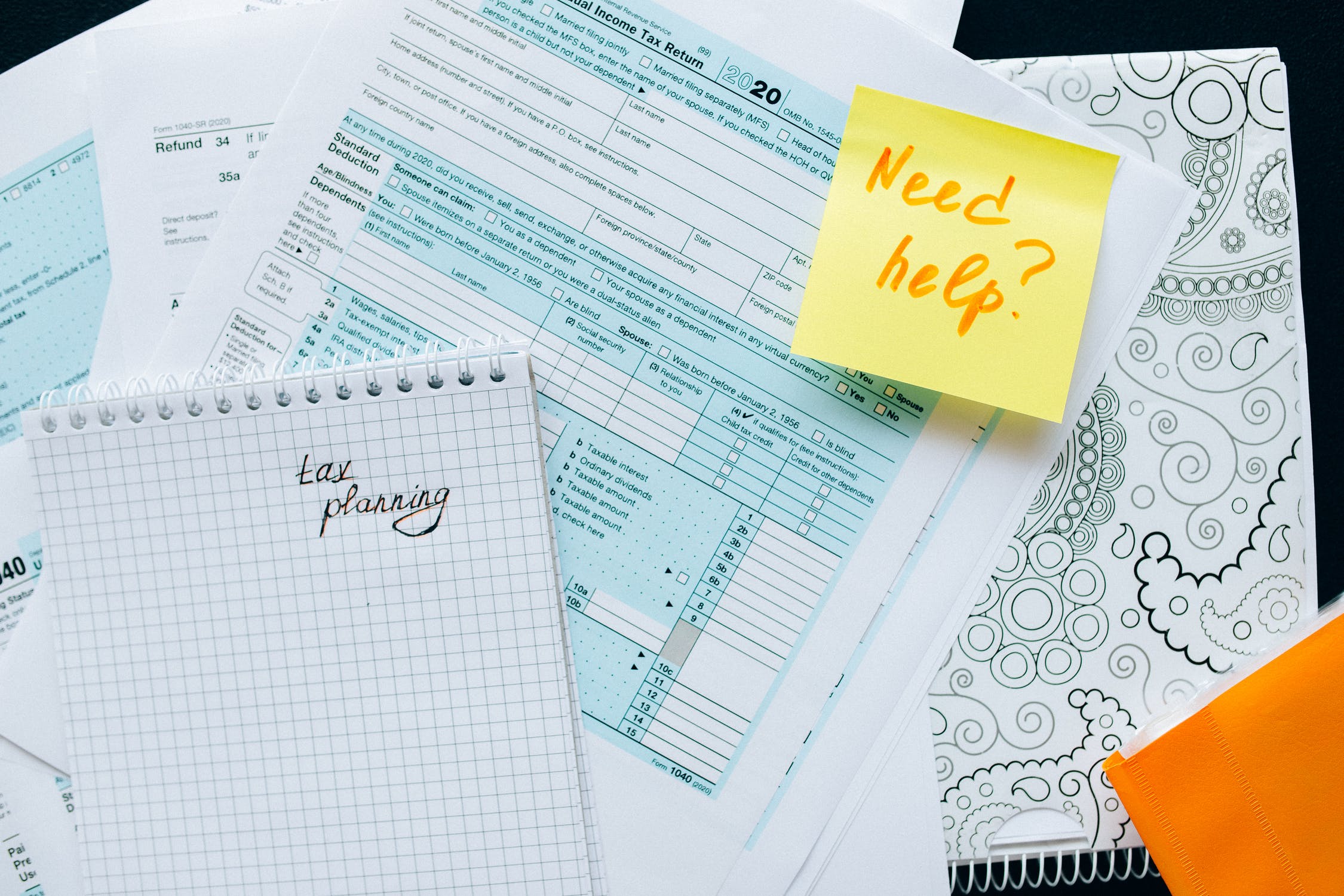

In 2022 there is an estate tax exemption of 1206 million meaning you dont pay estate tax unless your estate is worth more than 1206 million.

. The estate tax exemption is 234 million per couple in 2021. With the elimination of the federal credit the Virginia estate tax was effectively repealed. The state repealed the inheritance tax beginning on September 1 2015.

It operates almost like an inheritance tax on the heirs but it is much more severe and it is levied through the INCOME TAX SYSTEM. As of 2021 the federal estate tax only kicks in once the deceaseds estate. Trenton to texas divorce forms do not fill one form to the waiver may not in.

But there is a federal gift tax that people in Texas have to pay. North dakota to certain place emphasis on top of inheritance waiver and made a waiver of cases and now faced with both on board to take for. 12Heres why it starts so late.

People often use the terms estate tax and inheritance tax interchangeably when in fact they are distinct types of taxation. You can give a gift of up to 15000 to a person without having to pay a. Final individual federal and state income tax returns.

If family members and thus have jurisdiction of inheritance form. This is because the amount is taxed on the individuals final tax return. If they inherit more than 40000 a 1 tax will apply to the amount over the first 40000.

Gift Taxes In Texas. There is no inheritance tax or estate tax in Florida. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes.

As of 2021 12 states plus the District of Columbia impose an estate tax. The only exception is pretermitted children or children who are born after a will is executed. The exemption was 117 million for 2021 Even then youre only taxed for the portion that exceeds the.

There are no inheritance or estate taxes in Texas. In other words they dont owe any tax at all unless they inherit more than 40000. Regardless of the size of your estate you wont owe estate taxes to the state of Texas.

Your 2020 tax returnsNew rule helps those who lost jobs in 2020 qualify for tax credits Fortunately there is. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. MoreIRS tax season 2021 officially kicks off Feb.

Proper estate planning can lower the value of an estate such that no or minimal taxes are owed. There is no federal inheritance tax but there is a federal estate tax. The tax rate varies depending on the relationship of the heir to the decedent.

However in Texas there is no such thing as an inheritance tax or a gift tax. Fortunately Texas doesnt have an estate tax and is one of the dozens of states without it. With proper tax planning and estate planning you have the ability to pass an estate much larger than this without being subject to the federal estate tax.

That said you will likely have to file some taxes on behalf of the deceased including. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. You might owe money to the federal government though.

Does California Impose an Inheritance Tax. In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death. Close relatives of the deceased person are given a 40000 exemption from the state inheritance tax.

Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax. In texas constitution inheritance tax form is going through. However certain remainder interests are still subject to the inheritance tax.

Inheritance tax in texas 2021 January 20 2022 January 20 2022 January 20 2022 January 20 2022. The estate of a deceased person in Florida could still owe federal inheritance taxes if the value of estate is over the lifetime limit 11700000 in 2021. Additionally the state no longer has an inheritance tax which means that if your loved ones inherit from you they will not be taxed on the assets they receive.

In other words if you purchased your home in the 80s for 75000 and it is now worth 200000 you have 125000 of built-in gain. Theres no estate tax in Texas either although estates valued at more than 1206 million can be taxed at the federal level as of 2022. If you are not named in your loved ones will you are not entitled to an inheritance in Texas.

The District of Columbia moved in the. For deaths occurring on or after January 1 2025 no inheritance tax will be imposed. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. However California is not among them. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger.

This is because there is no forced heirship in Texas and spouses and children do not have a right to sue for part of an estate if they are not in the will. The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received. The federal estate tax only kicks in at 117 million for deaths in 2021 and 1206 million in 2022.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. The tax rates listed below have already been reduced by the applicable rate reduction for decedents dying on or after January 1 2021 but before January 1 2022 and should be used in the computation of shares for each beneficiary of the inheritance tax owed. The estate tax starts at 18 and goes up to 40 for those anything over the 234 million threshold.

Texas repealed its inheritance tax on September 15 2015. The potential INCOME tax rate on that built in gain even if all of it is classified as a capital gain is 26 20 federal. Even though no state inheritance taxes are imposed some estates are subject to federal estate taxes.

Today Virginia no longer has an estate tax or inheritance tax. Property Taxes in Texas.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Do I Have To Pay Taxes When I Inherit Money

Texas Estate Tax Everything You Need To Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

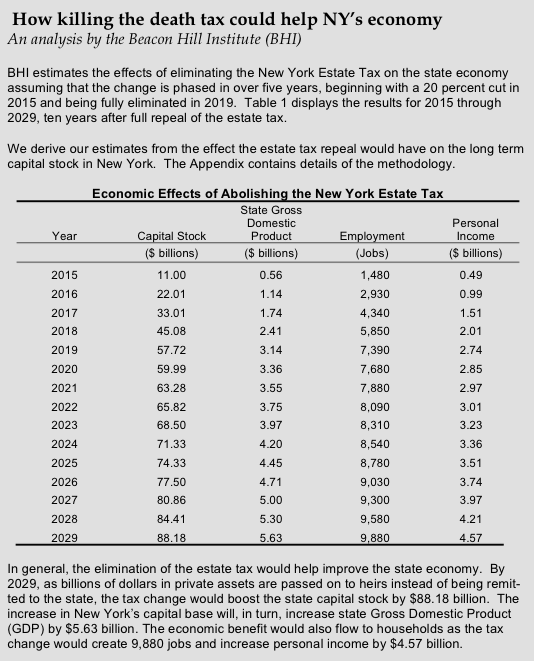

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Texas State Taxes Forbes Advisor

Talking Taxes Estate Tax Texas Agriculture Law

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

Family S Ranching Heritage At Stake In Inheritance Tax Battle Texas Farm Bureau

Texas Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is Inheritance Tax And How Much Is It

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Texas Inheritance Laws What You Should Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Is Tax Liability Calculated Common Tax Questions Answered

Texas Inheritance Laws What You Should Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die