osceola county property tax due date

Banks no post dated checks bruce vickers tax colelctor po box. 095 of home value Yearly median tax in Osceola County The median property tax in Osceola County Florida.

Osceola County Florida To Issue Stay At Home Order Walt Disney World Property Completely Under Local Orders Through April 9th

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get.

. Kissimmee FL 34744 You may submit a detailed asset listing in Excel format on CD along with your mailed 2021 Tangible Personal Property Tax Return to the above address or via email to. Osceola County Florida Property Tax Go To Different County 188700 Avg. Tax statements are mailed on November 1st of each year with payment due by March 31st of the.

Search all services we offer. Take your time reviewing all the regulations before you begin. Funds through a us.

Property taxes are due on September 1. What is the due date for paying property taxes in Osceola county. An owner of eligible property may file a completed summer property tax deferment form with his or her city or township treasurer before September 15th or before the date your summer taxes.

If you dont pay by the due date you will be charged a penalty and interest. Tangible Personal Property Returns Due. You can call the Osceola County Tax Assessors Office for assistance at 407-742-5000.

It is the job of the Tax Collector to mail the tax notices and collect the monies due. Applications for next years property tax installment payment plan due April 30th. Whether you are already a resident or just considering moving to Osceola County to live or invest in real estate estimate local property.

It may make sense to get service of one of the best property tax attorneys in. The service also allows the opportunity to pay real estate taxes over the counter at the County Treasurers Office using a credit or debit card. Perhaps youre unaware that a property tax bill may be bigger than it ought to be due to a distorted evaluation.

Learn all about Osceola County real estate tax. Ultimate Osceola Real Property Tax Guide for 2022. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

IMPORTANT DATES OSCEOLA COUNTY TAX COLLECTOR Office of Bruce Vickers CFC. Osceola county tax collector notice of ad valorem and non-ad valorem assessments must be paid in us. Osceola County tax office and their website provide the rules procedures and submission forms that you need.

Deadline to File for Exemptions. Service is available 24 hours a day 7 days a week. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a.

The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and a median effective property tax rate of. Property Appraiser Important Dates. Assessment Valuation End Date.

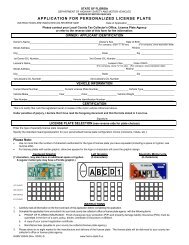

Application For Personalized License Plate Osceola County Tax

75 63 Acres M L Osceola County Gilman Township Stalcup Agricultural Service Inc

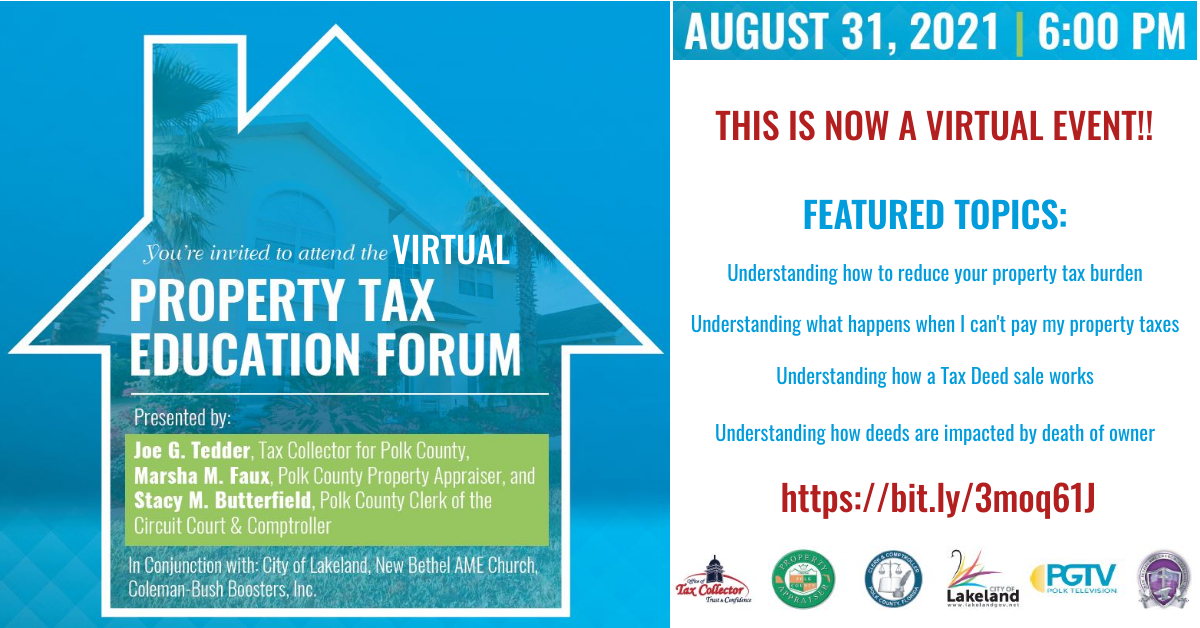

Polk County Constitutional Officers Present A Virtual Property Tax Education Forum Polk County Tax Collector

2021 Property Tax Roll Monroe County Tax Collector

Free Tax Irs Credit Help At Valencia Saturdays Through April Osceola News Gazette

Campbell City Tax Collector Civic Architect Design The Lunz Group

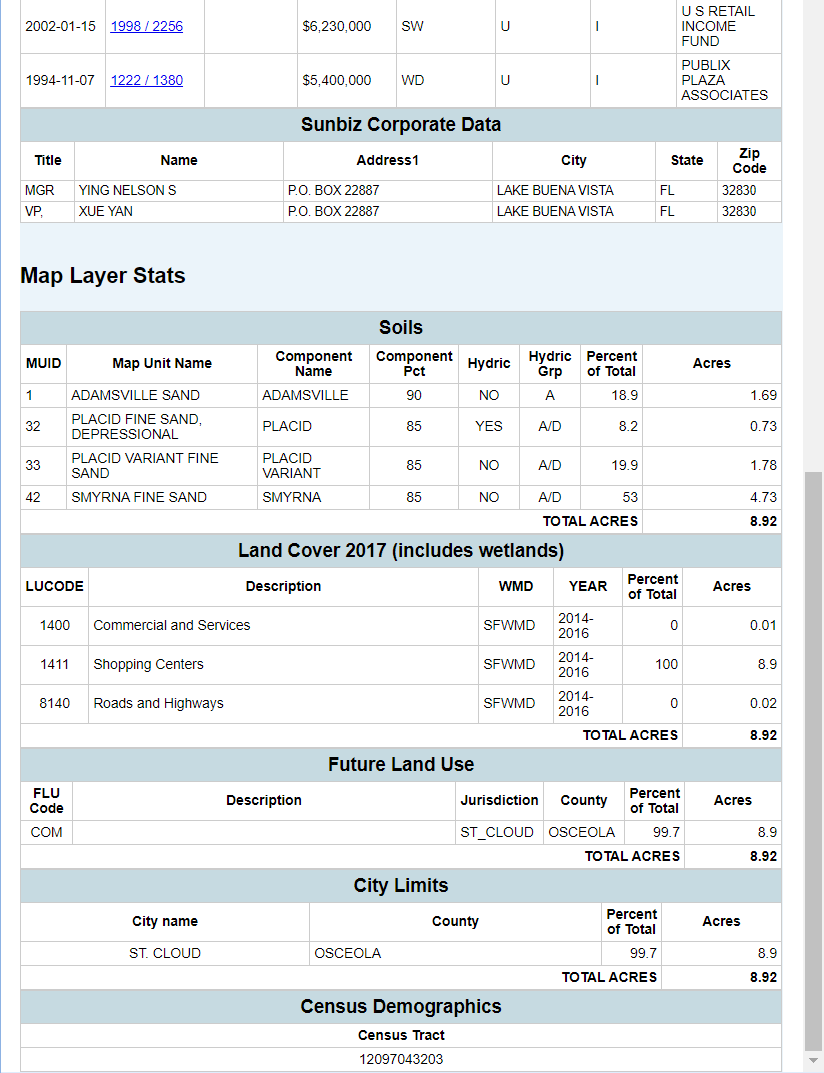

Florida County Property Appraiser Search Parcel Maps And Data

How To Pay Osceola County Tourist Tax For Vacation Rentals

Osceola Planning 500 Acre Innovative Tech Campus Orlando Business Journal

Tax Deed Sales General Information Osceola Clerk Of The Circuit Court Comptroller

How To Pay Osceola County Tourist Tax For Vacation Rentals

Solar Panel Installation In Osceola County Florida

2019 Tpp Return Form Dr 405 And Instructions Osceola County Fill And Sign Printable Template Online Us Legal Forms